Cost of Goods Sold COGS: What It Is & How to Calculate

Let’s consider an example to understand how COGS is calculated under the Periodic Inventory System. It is important to note that under the Periodic Inventory System, the inventory left at the end of the year (closing inventory) is counted physically. But Gross Profit alone would not help in comparing the efficiency of your business from year-to-year or Quarter-to-Quarter. Therefore, in order to achieve that, you need to calculate Gross Profit Margin. This means that the total amount directly traceable to the backpacks the store had to spend was $28,000.

- In a periodic inventory system, the cost of goods sold is calculated as beginning inventory + purchases – ending inventory.

- A business that produces or buys goods to sell must keep track of inventories of goods under all accounting and income tax rules.

- LIFO stands for Last In, First Out, and assumes that inventories purchased last should be recorded as being sold first.

- These costs are an expense of the business because you sell these products to make money.

- Whereas, in case your business maintains inventory records using a perpetual inventory method, the average cost is calculated using the moving average method.

- No matter how COGS is recorded, keep regular records on your COGS calculations.

- Since all these costs are indirect costs, these would not be considered while calculating COGS of Zoot for the year 2019.

Businesses like grocery stores and hardware stores have thousands of different products on their shelves, so tracing what specifically caused COGS to go up or down can be difficult. Let’s take the example of a backpack for a school supply store. Say that you had $10,000 cost of goods sold worth of backpacks at the start of the month, but it’s the last month of summer vacation, and so the store stocks up on an additional $20,000 worth of backpacks. At the end of the month, they have just $2,000 worth of backpacks to be sold to their customers.

Why is tracking cost important?

Beginning inventory is nothing but the unsold inventory at the end of the previous financial year. Whereas, the closing inventory is the unsold inventory at the end of the current financial year. After all, if your cost of goods sold is zero, that either means you’ve acquired your inventory for no cost whatsoever or you sold nothing. What you want to do is reduce COGS by lowering how much you spend on your inventory. To calculate the COGS for your backpacks in this example, you need to total the amount of inventory in your possession at the start of the time frame. To calculate your COGS number without running sums by hand, use a cost of goods sold calculator.

- The process for calculating the cost of goods sold is the same for all business types.

- Thus, the cost of goods sold is calculated using the most recent purchases whereas the ending inventory is calculated using the cost of the oldest units available.

- Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year.

- Therefore, in order to achieve that, you need to calculate Gross Profit Margin.

- That is to say that the decreasing COGS to Sales ratio indicates that the cost of producing goods and services is decreasing as a percentage of sales.

- COGS method is open to manipulations, it can be under the risk of being manipulated by overstating discounts or returns to suppliers, addition of obsolete inventory, inflated manufacturing costs.

Parts and raw materials are often tracked to particular sets (e.g., batches or production runs) of goods, then allocated to each item. When multiple goods are bought or made, it may be necessary to identify which costs relate to which particular goods sold. This may be done using an identification convention, such as specific identification of the goods, first-in-first-out (FIFO), or average cost. Alternative systems may be used in some countries, such as last-in-first-out (LIFO), gross profit method, retail method, or a combinations of these. Instead, they would include the cost of those items as tax deductions for operational costs.

Cost of goods sold on an income statement

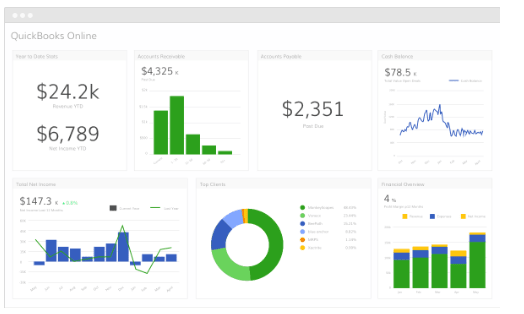

COGS is an important metric on the income statement of your company. This is because the COGS has a direct impact on the profits earned by your company. Therefore, we can say that inventories and cost of goods sold form an important part of the basic financial statements of many companies.